gst on commercial property sale malaysia

24 February 2016. The options in our database are limitless.

Pav Sikham President Paddington Properties Linkedin

It emphasizes on the RENTAL though.

. Capital gains tax is referred to as RPGT in Malaysia and differs depending on your holding period and whether you buy residential or commercial property. May 4 2016. It has been announced that the sale or leasing of residential property will be spared the value-added tax as it is categorized exempt-rated.

Property sector still grappling with GST issues. In this article we explain how home and property prices will be affected moving forward. Whether buying selling or leasing you will be classified as an enterprise and according to Australian Tax Office once an investor or developers turnover is at or above 75000 they are liable to pay GST.

The general GST treatment where real properties are leased is as follows. The supplies which are subjected to GST include the supply of all types of. According to the DGC if you own.

Depending on certain conditions being met as determined by the Director-General of Customs DGC a sale of a commercial property may be subject to GST. If you are not required to register for GST and you are selling a residential property you do not need to register even if the price exceeds RM500000. The sale and lease of properties in Singapore are subject to GST except for residential properties.

Shop is a taxable supply iii the lease of long term commercial. Real estate agents must charge GST on the brokerage fees received from the real estate agencies. GST has however made things simpler for landlords of commercial real estate.

Sales of commercial real estate such as office towers retail buildings and land zoned for commercial use are subject. There are 21480 commercial properties for sale. The current regulations might confused a lot of people who originally thought they were exempt from this levy according to Deloitte Malaysia an.

However for the leasing of commercial property will be subject to 6 GST. Only revenue of Rs. Do you need to pay GST on commercial property.

The sale of the 100 residential houses is. Your residential status will also affect the rates that apply. What are the supplies subject to GST in the real estate industry.

GST is also chargeable on the supply of movable furniture and fittings in both residential and non-residential properties. Browse genuine industrial property listings with a peace of mind. Unlike residential properties the sale of commercial properties is a clear cut case which falls under the Standard-rated supply and is taxable under the GST.

So it is wise to transfer your commercial title holder to individuals if you are a registered GST entity company before 1April2015. I the lease of private residence eg. Updated 29 Apr 2022 By Team Loanstreet.

If sold within 3 years. By 9 July 2015 we usher 100 days on from the start of GST one of the major pieces of tax reform the country has seen. Thanks for the source but the paper does not spelled out clearly on the SALE of commercial property from a non-GST entity.

Property sellers will have to pay a 6 GST which is calculated from the gross selling price to the Royal Malaysian Customs RMC. RPGT increases progressively as follows for commercial property. Now look back again on the first two question above we as a property investor answer the following questions.

Ad Our professional sales agents will assist you to find your ideal factory or warehouse. Sales of commercial real estate such as office towers retail buildings and land zoned for commercial use are subject to a 6 percent GST if the seller is an individual is engaged in the business. New guidelines were issued recently by the Royal Malaysian Customs Department that includes more people being required to pay the Goods Services Tax GST when selling a commercial property The Star reported.

As one of the most sophisticated sectors undoubtedly property and construction industry faced greater challenges in complying with GST rules. The sale of the 20 commercial and 10 industrial units are subject to GST. Any type of immovable property rented out for commercial purposes however would be subject to an 18 GST.

In most cases yes you will be required to pay GST on a commercial property purchase. In Malaysia a person who is registered under the Goods and Services Tax. 20 lakhs or more is now subject to the GST on commercial rental income.

The sale of a residential property is an exempt supply. More than 2 commercial. For more information please refer to Commercial Property More Than RM2 Million have to Registered for GST in Malaysia.

Anyway great effort bro. Use our elegant property search tool to find the right shops shop offices offices retail spaces soho factories and warehouses that are currently for sale. If sold before 4 years.

It is inevitable that home prices will also be affected. Instead of beating around the bush there is a clear pricing scheme for properties of these kind where there is a segregation between the. An apartment is an exempt supply ii the lease of commercial property eg.

Residential homes are excluded from GST under the current rules. With the coming implementation of Goods Service Tax GST in April 2015 many Malaysians are concerned with what this bodes for prices in general.

109 Commercial Real Estate Properties For Sale In Collingwood Vic 3066

Pav Sikham President Paddington Properties Linkedin

109 Commercial Real Estate Properties For Sale In Collingwood Vic 3066

Pav Sikham President Paddington Properties Linkedin

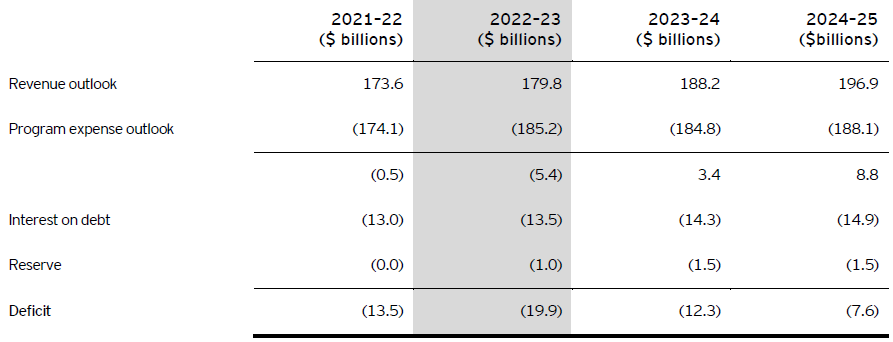

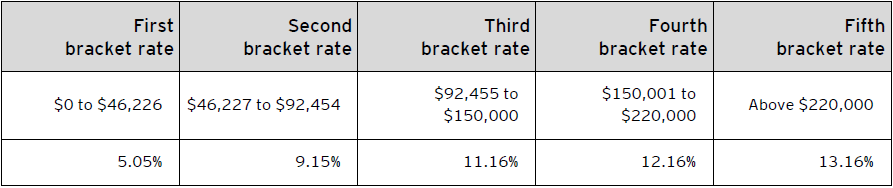

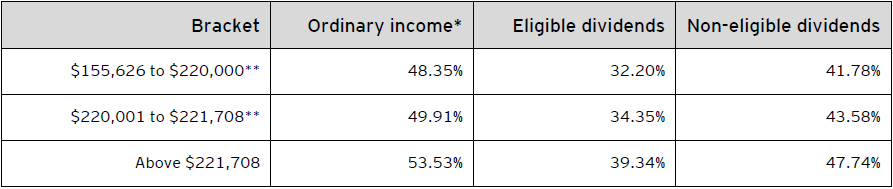

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

109 Commercial Real Estate Properties For Sale In Collingwood Vic 3066

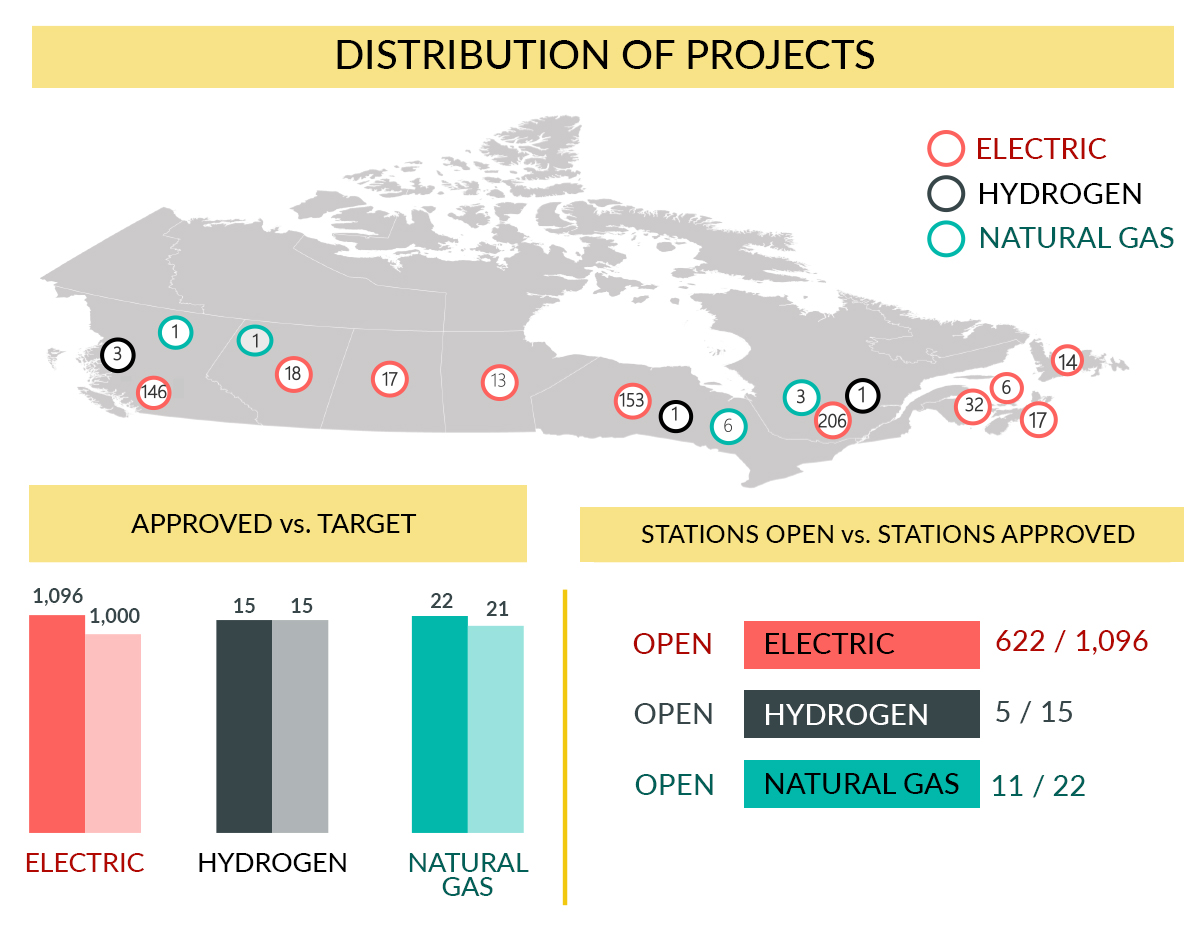

Electric Vehicle And Alternative Fuel Infrastructure Deployment Initiative

How Is A Commercial Property Loan Different From A Home Loan

Pav Sikham President Paddington Properties Linkedin

Hst Fact Summary Sheet Real Estate Lawyers Mississauga

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

109 Commercial Real Estate Properties For Sale In Collingwood Vic 3066

How Is A Commercial Property Loan Different From A Home Loan

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

Top 10 Highest Paying Accounting Careers Brighton College

109 Commercial Real Estate Properties For Sale In Collingwood Vic 3066